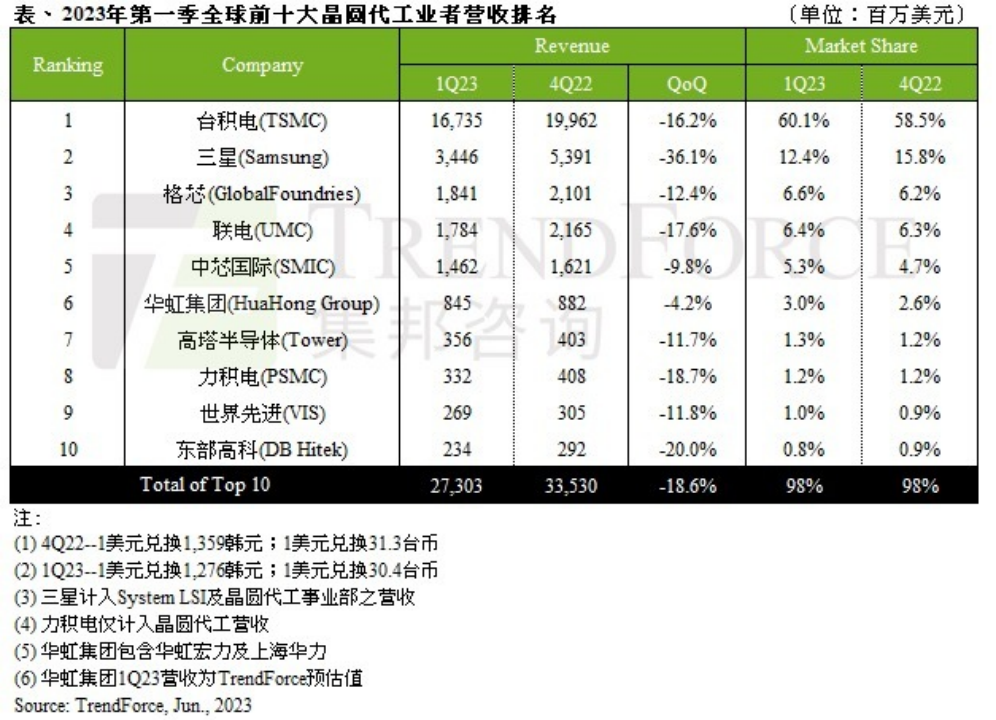

According to the research of rendForce Jibang Consulting, the revenue of the world's top ten wafer OEMs fell 18.6% in the first quarter, about US $27.3 billion, due to the continued weakness of terminal demand and the addition of off-season effects.

The biggest change in this ranking is that GlobalFoundries surpassed United Electronics to take the third place, and Tower Semiconductor surpassed Powerchip and Vanguard International Semiconductor Corporation to take the seventh place this quarter.

The decrease in capacity utilization and shipment volume has led to an increase in revenue decline

The decrease in revenue in the first quarter was mainly affected by the decline in capacity utilization and shipment volume of the top ten contracted factories. For example, TSMC's revenue was 16.74 billion US dollars, a decrease of 16.2% in quarterly revenue. The weakening demand for mainstream applications such as laptops and smartphones has led to a significant decrease in the utilization and revenue of 7/6 nm and 5/4 nm processes, with a decrease of over 20% and 17% respectively. Although orders in the second quarter may temporarily ease, the continued low capacity utilization rate indicates that revenue may continue to decline, although at a slower pace compared to the first quarter.

Samsung's production capacity utilization of 8-inch and 12-inch wafers decreased, resulting in a 36.1% decrease in revenue in the first quarter, the highest decline among companies in the first quarter, to $3.45 billion. Although there were sporadic orders for certain components in the second quarter, it should be noted that most of these orders were driven by short-term inventory replenishment, rather than a strong signal of improved end market demand. The launch of new 3 nanometer products is expected to contribute to revenue in the second quarter, which may slow down the pace of decline.

Global Foundries reported revenue of $1.84 billion in the first quarter, a decrease of 12.4% quarter on quarter. Since the market turned better in the second half of last year, Global Foundries has maintained a stable operation due to the strong demand of many industries such as American automobile, defense, industrial equipment and government applications. This sustained performance led Global Foundries to surpass Liandian in revenue in the first quarter, ranking third. Looking forward to the second quarter, the company is expected to benefit from stable orders in the Industrial internet of things, aerospace and defense, and automotive industries, support capacity utilization, and achieve revenue levels similar to those in the first quarter.

According to a report from Liandian, revenue in the first quarter decreased by 17.6% to approximately $1.78 billion. This decrease is particularly significant for the 28/22nm and 40nm processes, both of which have decreased by at least 20%. Due to a decrease in customer orders for PMIC and MCU, the company's 8-inch wafer capacity utilization is expected to drop below 60% in the second quarter of 2013. However, its 12 inch capacity utilization will benefit from urgent orders for 28/22 nm products, such as Tcon and TV SoC, with an expected utilization rate of 80%. Given the stability of ASP, Liandian's revenue is expected to remain stable or slightly increase in the next quarter.

Semiconductor Manufacturing International Corporation reported revenue of $1.46 billion in the first quarter, down 9.8% quarter on quarter. Due to the diversification of product portfolio and support from domestic demand in China, the revenue of 8-inch wafers has decreased by nearly 30%, while the revenue of 12-inch wafers has slightly increased by 1-2%. Semiconductor Manufacturing International Corporation is expected to benefit from the recovery of orders for specific products such as Driver IC and Nor Flash, and will continue to benefit from China's demand. It is expected that both shipment volume and capacity utilization will increase, thereby achieving revenue growth.

The weak demand for consumer goods has severely hit the income of Powerchip and Vanguard International Semiconductor Corporation

Since the second half of 2022, the OEM industry has been on a downward trend. Due to the limitations of process technology and high overlap of products, the second and third tier OEMs are facing fierce competition and lack of Bargaining power. Therefore, in the context of market downturn, their business performance is even more unstable. The biggest change in the sixth to tenth place in the first quarter was Tower Semiconductor, which rose to the seventh place. Based on the support of European market demand, the revenue fell 11.7% month on month, about $360 million, a slight decline compared with the most second and third tier manufacturers.

Powerchip benefited from the replenishment of TV related LDDI inventory, and its HV process revenue increased by 26%. However, other platform products such as PMIC and Power discrete are still undergoing inventory adjustments, and customers' willingness to place orders remains cautious. The company's revenue in the first quarter reached approximately 332 million US dollars, a decrease of 18.7% in the quarter.

Similarly, as inventory levels approach healthy levels, Vanguard International Semiconductor Corporation (VIS) has witnessed the recovery of wafer orders from large and small DDI customers. However, PMIC wafer orders remain weak. VIS's revenue in the first quarter was approximately $269 million, a decrease of 11.8%. Other companies, including Huahong Group, reported revenue of approximately 845 million US dollars in the first quarter, a decrease of 4.2% from the previous quarter. DB Hitek's revenue was $234 million, a 20% quarter on quarter decrease.

TrendForce predicts that although the decline is lower than in the first quarter, the revenue of the top ten wafer fabs in the second quarter will continue to decline. The supply chain is expected to gradually establish inventory to meet the peak demand in the second half of the year, but the accumulation of inventory and slow consumption are currently suppressing customers' attitudes towards inventory. Therefore, it is expected that the overall production cycle of wafer fabs will be more relaxed in the second quarter, with limited growth in capacity utilization. Only sporadic rush orders for TV SoC, WiFi 6/6E, and TDDI products are expected to significantly increase usage.

Recommend News

-

Phone

400-9682 003